Recognizing the Process Behind an Online Tax Return in Australia and How It Functions

Recognizing the Process Behind an Online Tax Return in Australia and How It Functions

Blog Article

Navigate Your Online Income Tax Return in Australia: Crucial Resources and Tips

Browsing the on the internet income tax return procedure in Australia needs a clear understanding of your commitments and the resources available to simplify the experience. Important files, such as your Tax File Number and revenue declarations, have to be diligently prepared. Selecting an appropriate online platform can considerably impact the efficiency of your declaring procedure. As you take into consideration these elements, it is crucial to also recognize common mistakes that numerous experience. Recognizing these nuances could inevitably conserve you time and decrease stress-- leading to a much more desirable result. What techniques can best aid in this undertaking?

Understanding Tax Responsibilities

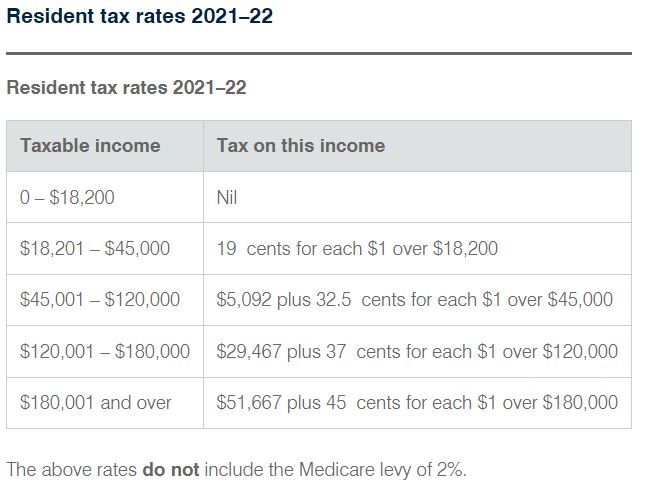

Understanding tax obligation obligations is necessary for individuals and organizations operating in Australia. The Australian taxation system is regulated by numerous regulations and regulations that call for taxpayers to be knowledgeable about their duties. Individuals should report their earnings accurately, which consists of incomes, rental income, and investment incomes, and pay tax obligations accordingly. Moreover, homeowners need to understand the difference in between taxed and non-taxable revenue to ensure compliance and enhance tax obligation end results.

For companies, tax obligations encompass multiple aspects, consisting of the Product and Solutions Tax (GST), company tax, and pay-roll tax. It is crucial for companies to register for an Australian Organization Number (ABN) and, if suitable, GST registration. These obligations require meticulous record-keeping and prompt submissions of tax obligation returns.

Additionally, taxpayers need to know with available deductions and offsets that can minimize their tax worry. Consulting from tax obligation experts can offer beneficial insights right into enhancing tax settings while making sure conformity with the regulation. On the whole, a thorough understanding of tax obligation responsibilities is crucial for efficient economic planning and to prevent penalties associated with non-compliance in Australia.

Essential Papers to Prepare

Furthermore, compile any appropriate bank declarations that mirror interest income, in addition to returns statements if you hold shares. If you have various other resources of revenue, such as rental residential properties or freelance job, guarantee you have documents of these revenues and any kind of linked expenditures.

Consider any kind of personal health insurance declarations, as these can impact your tax responsibilities. By collecting these essential papers in advancement, you will certainly improve your on the internet tax return procedure, decrease errors, and make the most of prospective reimbursements.

Selecting the Right Online System

As you prepare to file your on-line tax return in Australia, picking the best system is necessary to guarantee accuracy and convenience of use. A number of vital aspects ought to guide your decision-making process. Initially, consider the system's user interface. An uncomplicated, user-friendly design can dramatically enhance your experience, making it much easier to browse intricate tax kinds.

Next, evaluate the system's compatibility with your monetary scenario. Some services provide especially to people with simple income tax return, while others supply comprehensive support for much more complex situations, such as self-employment or investment earnings. Look for platforms that offer real-time mistake monitoring and support, assisting to lessen blunders and making sure conformity with Australian tax laws.

An additional vital facet to take into consideration is the degree of customer support available. Dependable platforms need to offer access to support via conversation, e-mail, or phone, especially throughout height filing periods. In addition, research study user reviews and ratings to gauge the total contentment and dependability of the system.

Tips for a Smooth Declaring Process

Submitting your on the internet tax return can be a straightforward procedure if you comply with a few crucial suggestions to ensure performance and accuracy. Gather all needed records prior to starting. This includes your earnings statements, receipts for deductions, and any type of other pertinent paperwork. Having everything available decreases mistakes and interruptions.

Next, benefit from the pre-filling function offered by numerous on the internet systems. This can conserve time and minimize the chance of mistakes by automatically occupying your return with info from look at this now previous years and information provided by your employer and banks.

Furthermore, double-check all entries for accuracy. online tax return in Australia. Errors can cause postponed reimbursements or concerns with the Australian Taxes Workplace (ATO) Make certain that your individual details, earnings figures, and deductions are right

Be conscious of target dates. If you owe taxes, declaring early not just lowers anxiety however also enables browse around these guys for much better planning. Finally, if you have unpredictabilities or inquiries, speak with the help areas of your selected platform or seek professional suggestions. By complying with these suggestions, you can navigate the online tax obligation return process smoothly and with confidence.

Resources for Aid and Support

Navigating the intricacies of online income tax return can often be daunting, yet a selection of sources for assistance and assistance are readily available to aid taxpayers. The Australian Tax Office (ATO) is the main resource of info, supplying comprehensive overviews on its site, consisting of Frequently asked questions, training video clips, and live chat alternatives for real-time assistance.

Furthermore, the ATO's phone assistance line is available for those that choose straight interaction. online tax return in Australia. Tax experts, such as registered tax representatives, can additionally offer individualized guidance and make sure investigate this site conformity with current tax regulations

Verdict

To conclude, efficiently navigating the on the internet income tax return procedure in Australia calls for a thorough understanding of tax obligations, careful prep work of necessary records, and mindful option of an ideal online platform. Following sensible pointers can improve the declaring experience, while readily available sources use useful help. By approaching the process with diligence and attention to information, taxpayers can make sure compliance and maximize possible advantages, inevitably adding to a more effective and effective tax return outcome.

As you prepare to submit your on the internet tax obligation return in Australia, choosing the right system is important to make sure accuracy and convenience of use.In verdict, successfully navigating the on the internet tax obligation return procedure in Australia needs a comprehensive understanding of tax obligation responsibilities, meticulous prep work of important records, and careful selection of an ideal online platform.

Report this page